The Basics of EIN and How Businesses Can Acquire One

Everything You Need to Know

One of the final stages of starting a new business or launching a side business operation is to obtain an Employer Identification Number. While this step appears overly complex to some entrepreneurs, it’s essential to complete it, especially if it is mandatory in your state.

The best way to stay motivated to learn how to acquire an EIN is to understand how it can benefit your company.

Below you will find everything you need to know about an EIN, including business benefits, and discover two ways to obtain it.

EIN explained

As a future business owner, you’ve probably heard about the Internal Revenue Service (IRS). It’s a federal government body collecting US federal taxes and administering the Internal Revenue Code. The IRS is also in charge of assigning EINs to businesses. What is an EIN exactly?

An EIN is a unique nine-digit number assigned to companies for tax purposes. It’s like a social security number for businesses. With an EIN, companies can stay on top of their taxes and have employees on a payroll. It is also included on tax filing forms and related documents.

Some business structures require an EIN, such as partnerships, LLCs, and corporations, while others, such as sole proprietorships, don’t need it. However, if a sole proprietorship wants to hire employees, offer a retirement plan, or file for bankruptcy, it also must obtain an EIN.

Why businesses need an EIN

Now that you understand EIN basics, you are ready to learn about the benefits it can offer to you and your company.

Avoiding tax penalties and filing taxes more easily

If your business structure requires an EIN and you don’t have one, you are exposed to tax penalties. The only option to prevent this is to acquire an EIN from the IRS before tax deadlines and file your taxes on time. Tax filing forms are easy to complete and come with a mandatory EIN field that you must fill out before submitting your taxes.

Preventing fraud and theft

One of the notable benefits of having an EIN is preventing fraud and theft. This is because once you have an EIN, you can separate your private and business finances. You will no longer have to provide your SSN when doing business with vendors or clients. The result is that you can keep your SSN private, preventing criminals from stealing it.

Building credibility

Whether you are launching a B2C or B2B establishment, you are about to enter a world of business where you’ll have to deal with fierce competition. The best way to attract more customers, clients, and powerful partners is to present as a responsible business owner committed to your company. An EIN can help you to do this as it paints you as a serious business owner.

Speeding up business loans

Loans are often a lifeline for companies that have just entered the market. Every loan company has a similar procedure for loan approval for businesses. Without an EIN, you will have to provide additional insurance and do more paperwork. An EIN helps you to speed up the business loan process and offers the opportunity to apply for loans with the best interest rates.

Creating business credit

If you want to apply for credit for your business, the bank or loan company will look into your business credit history. This is similar to your personal credit history. The only difference is that business credit history shows your past financial interactions with vendors, suppliers, and clients.

An EIN enables you to develop business credit, and banks and loan companies will be able to quickly and efficiently check your business credit history every time that you apply for credit using your EIN.

Hiring employees more easily

Your company’s payroll system is tied to your EIN. Basically, you can’t set it up without an EIN. Your EIN enables your company to have staff on payroll. It makes hiring employees straightforward and helps you to attract top talent in your niche so that you can establish your business on a path to success.

Which businesses don’t need an EIN?

We’ve already mentioned that sole proprietorships don’t need an EIN under specific circumstances. However, there are other business structures that aren’t required by law to have an EIN.

If you are an independent contractor, you don’t need to have one. The same rule applies to people with side jobs as well as those who run and manage small home businesses. Freelancers who use specialized platforms to do business with their clients also don’t need an EIN.

Can you get an EIN without an SSN?

Many individuals are under the impression that they need an SSN to obtain an EIN.

The good news is that if you live in the US and want to start your business there, you don’t need an SSN to acquire an EIN. In other words, even non-US citizens can still get an EIN.

The IRS enables people without an SSN in the US to secure an EIN and start a business. There is a form (Form SS-4) that must be used if you don’t have an SSN. You must complete all of the required fields and submit the form via mail.

When applying, you only need to provide essential information about your business, including your business name, entity type, and location. Since it takes time to process your form, it’s recommended that you submit Form SS-4 at least one month before you need to use your EIN.

How to get an EIN with the IRS

The process of receiving an EIN with the IRS is straightforward. Once you have all of the required information ready, you can complete the entire process in a couple of minutes. Here are all of the steps required to complete.

Step 1. Apply for your number with the IRS

The IRS offers all EIN applicants this service for free. You have four options: apply by fax, mail, phone, or online. The online application is the easiest method but it requires an SSN, an ITIN (Individual Taxpayer Identification Number), or an EIN. Other options require that yo submit a completed Form SS-4 via mail.

Step 2. Provide all required information

During the application process, you will need to disclose all of the required information. Preparing before starting the application is essential to have it completed quickly. Here is what you need to provide:

- The company’s legal name;

- The applicant’s legal name;

- Trade name, if you have one;

- Business location (the country, state, and street and mailing addresses);

- Responsible party’s information (an SSN or a previously obtained EIN);

- Business entity type;

- Company start date;

- Workforce size; and

- The company’s primary activity.

Step 3. Answer LLC questions

If you want to get an EIN for an LLC, you will need to provide additional information:

- Number of members in the LLC;

- SSN or TIN of the responsible party (owner, member, or managing member of the LLC);

- Name of the LLC;

- LLC location (territory, state, country);

- State and territory where articles of organization will be filed;

- Start date of LLC;

- If the LLC involves gambling or wagering;

- If the LLC has a highway motor vehicle weighing at least 55,000 pounds, which incurs taxes;

- If your company must pay excise tax returns quarterly;

- If your company makes or sells alcoholic beverages, weapons, or tobacco products;

- If you have employees who will be issued W-2 Forms in the next year;

- If you anticipate your employment tax liability to be $1,000 or less;

- Dates when you first paid or will pay wages; and

- What your company does (Select an option from the list).

Step 4. Identify your entity

You can significantly speed up your application process when selecting the business entity for which you need to obtain an EIN. In the EIN application form, you can specify that you need to obtain an EIN for the following:

- Sole proprietorship;

- Corporation;

- LLC;

- Partnership;

- Personal service corporation;

- Church-to-church-controlled organization; or

- Other nonprofit organization.

Step 5. Provide the reason for your application

Next, you need to specify a reason for applying:

- Starting a new business;

- Hiring employees;

- Complying with IRS withholding regulations;

- Banking purpose;

- Changing your type of organization;

- Purchasing an existing business;

- Creating a trust; or

- Creating a pension plan.

Step 6. Provide tax and account details

Finally, you must specify your expectations regarding your employment tax liability. If you expect it to be $1,000 or less in a full calendar year, you can file Form 944 annually. Otherwise, you will have to file Form 941 every quarter.

Step 7. Sign your application

Once you’ve completed all of the steps listed above, you can sign and submit or mail/fax your application for an EIN. If you apply online, the information is validated in real-time, and you will receive your EIN immediately. If you do it by fax, you can expect your EIN in four days, while applying by mail takes up to four weeks to get one.

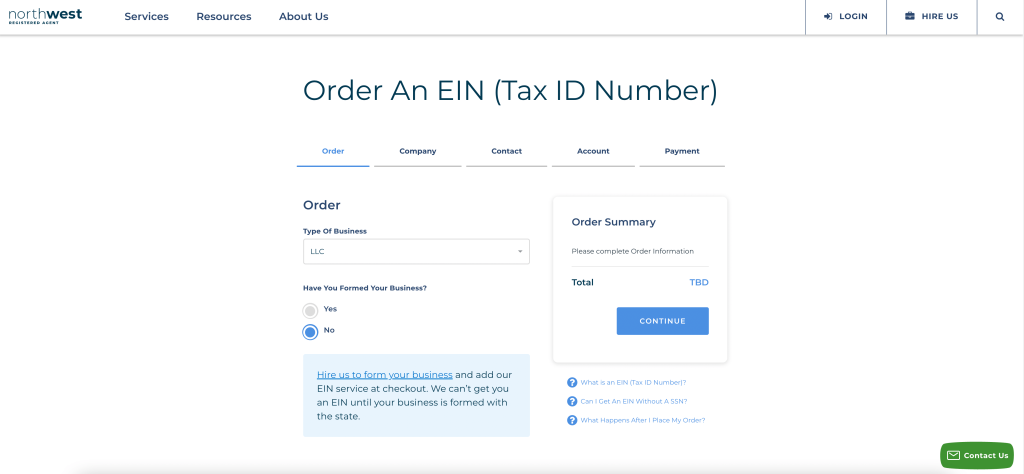

How to get an EIN using a third-party service

You can choose another option if you need to get an EIN. Instead of doing everything yourself, you can receive an EIN using a third-party service such as Northwest. This is a much easier and hassle-free option, because you can outsource the process to an experienced professional specializing in applying for and acquiring EINs for businesses.

The cost of outsourcing the EIN application to Northwest is also affordable.

It costs $50 if you have an SSN and $200 if you are not a US citizen, while you can secure complete incorporation, registered agent service, business forms, and an EIN for $275 plus state fees.

The process is relatively simple. Once you hire Northwest, the company’s professional staff will gather all of the necessary information and file your application with the IRS. Northwest will also work with the IRS to resolve any potential problems.

Conclusion

Hopefully, now you understand what an EIN is. As you can see, getting an EIN for your company offers many benefits, such as better creditworthiness, an easier time applying for business loans, and avoiding tax penalties. However, obtaining it can be overwhelming, especially for new business owners who haven’t done it before.

That’s where third-party service providers can be helpful. You can secure your EIN at an affordable price, and since you are about to launch a brand, you can spend precious time on more pressing matters.